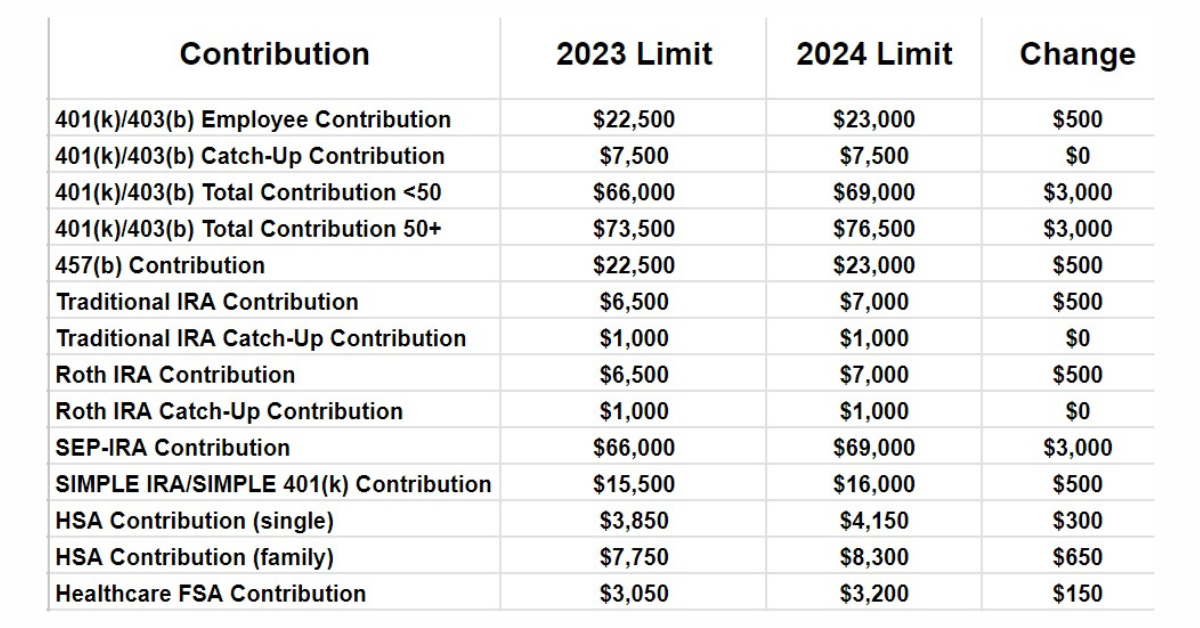

Irs Roth 401k Contribution Limits 2025. The 2025 401 (k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500. The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025.

Irs raises 401k and ira contribution limits for 2025 retirement plans. The 401 (k) contribution limits in 2025 have increased for employees to $23,000.

The simple ira and simple 401 (k) contribution limits will increase from $15,500 in 2025 to $16,000 in 2025.

The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you’re younger than age 50.

Irs Limits On 401k Contributions 2025 Meg Margeaux, 2025 health savings account (hsa) contribution. The 2025 401 (k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, The contribution limits apply to several types of retirement accounts, including: The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

2025 Charitable Contribution Limits Irs Linea Petunia, Retirement savers are eligible to put $500 more in a 401. This is an extra $500 over 2025.

2025 Contribution Limits Announced by the IRS, There are significant changes to roth 401 (k) accounts to be aware of this year. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, If the employee is at least. The irs has raised the annual contribution limit for roth 401 (k)s to $23,000 for 2025.

Contribution Limits Roth Ira 2025 Karie Juieta, Limits are still increasing in 2025, just not as. Here are more details on the contribution limit and how you can take advantage of this unique retirement account.

401k 2025 Contribution Limit IRS Under SECURE Act 2.0, Limits for those under age 50 went up by $3,000 for traditional and roth 401 (k)s and $1,500 for simple 401 (k)s. The 2025 401 (k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500.

401k Contribution Limits 2025 Fidelity Athena Aloisia, The 401 (k) contribution limits in 2025 have increased for employees to $23,000. By delving into the nuances of irs regulations, ridgway empowers listeners to make informed decisions regarding their retirement savings.

2025 Roth 401k Evie Oralee, This limit includes all elective employee salary deferrals and any contributions made to a. The irs has raised the annual contribution limit for roth 401 (k)s to $23,000 for 2025.

What’s the Maximum 401k Contribution Limit in 2025? (2025), This is an extra $500 over 2025. If less, your taxable compensation for the year.

The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50.